REAP THE REWARDS FOR MANAGING YOUR CREDIT WELL

We strive to provide our members with the best possible rates, so you can get more for less.

THE LOAN ZONE

We’re the loan experts who call Ohio home.

Check out competitive rates that OC Federal Credit Union is known for. Our in-house underwriting and loan processing can make your loan experience affordable and hassle-free.

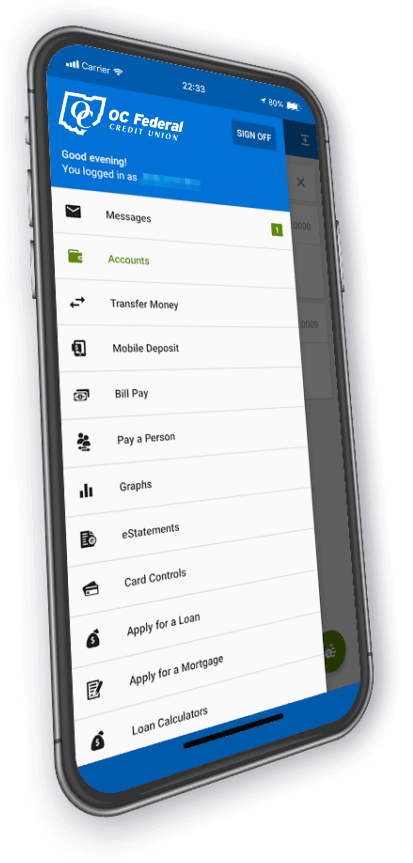

MANAGE

YOUR MONEY

24/7

ONLINE BANKING

MOBILE BANKING

MOBILE WALLET

CARD CONTROLS

MANAGE

YOUR MONEY

24/7

Make the Most of Your Money With OC Federal

Why Bank With Us?

Because you deserve a superior banking experience.

Enjoy low rates and fees, cutting-edge security and unmatched customer service… It’s why you should choose a credit union over a bank and why OC Federal is the credit union for you.